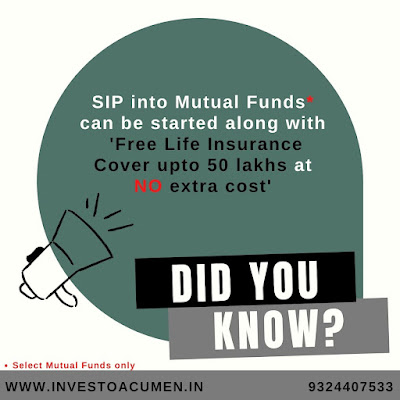

SIP with Insurance into Mutual Funds gives dual benefit

♦️ Creates Wealth over long term

♦️ Free - Life Insurance Cover

It is ideal for Under Graduates and Home Makers who generally find it difficult to get a Term Insurance because of lack of sufficient Income proofs.

Happy Investing !!