Confession Time !!

Today and in few of the future posts I will pen down some of the financial mistakes I made in my life,cause I don't want others to commit the same mistake.

I started earning right after I completed my graduation at the age of 21. I was earning around Rs 8000 a month, with no responsibilities to shoulder.

I did not invest much then except in a Life Insurance Policy. I felt liberated, with money in my hand and no one to answer to.

At 21, had I kept 'Retirement' as a goal and would have started investing only Rs 5000 per month and increased it by 10% every year and invested in Equity Mutual Funds, after 24 years, today, I would have been sitting on a whopping corpus of Rs 2 Crores.

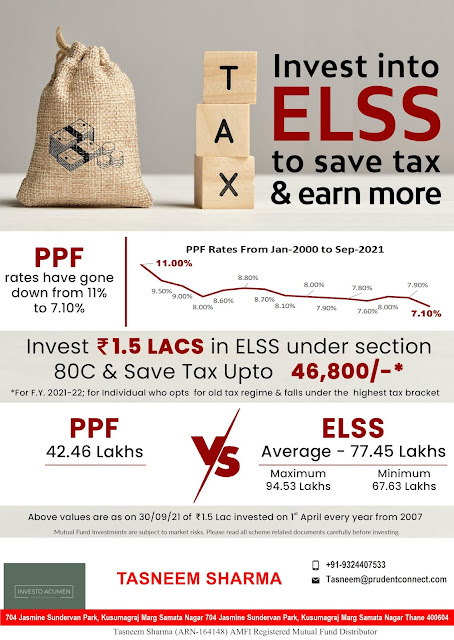

So the key is think of retirement the day you start earning and invest in instruments capable of giving 2 digit returns.

Please share this with people you care for especially the Young Population (18-25 Yrs).

Happy Investing !!